Keep staff accountable using our 4-Step Method

Agencies all over the country struggle with holding their staff accountable. Too often, I talk with agency owners that avoid uncomfortable conversations due to fear of confrontation, or they hope things magically improve over time. As we all know, that rarely happens! Enter our 4-Step Method for keeping agents accountable!

Step 1: As an agency owner, what can you do about accountability?

First, always remember that a conflict delayed is a conflict multiplied. The best time to deal with a potentially negative situation is now.

Second, people will always care about themselves and their families more than anyone else, which is the key to accountability. For example, you as the agency owner probably care about your own family’s income more than the CEO of your carrier. Your staff feels the same, and they will always care more about themselves.

Discussing agency goals, bonuses, etc., can yield a very positive result in accountability. Instead of making accountability about your agency, you should make it all about them and their financial goals.

Step 2: How do you “make it all about them”?

First, you have to find out what financially drives them and help them create a plan to make that happen. Ask what their “financial why” is.

Potential why’s:

- Do they want to pay off credit cards?

- Buy a house?

- Send their kids to a specific college?

Whatever it is, work with them to create their financial plan and hold them accountable to that plan.

Step 3: How do I help them make their financial plan?

Let’s say they want to get out of their apartment and buy a house.

Here are steps to take to build that financial plan:

- Ask them how much they will need for the down payment.

- Determine the difference in their rent and potential mortgage payment.

- Then, ask what their ideal timeline is to purchase a home. i.e., When does their lease expire, or what is their ideal move date.

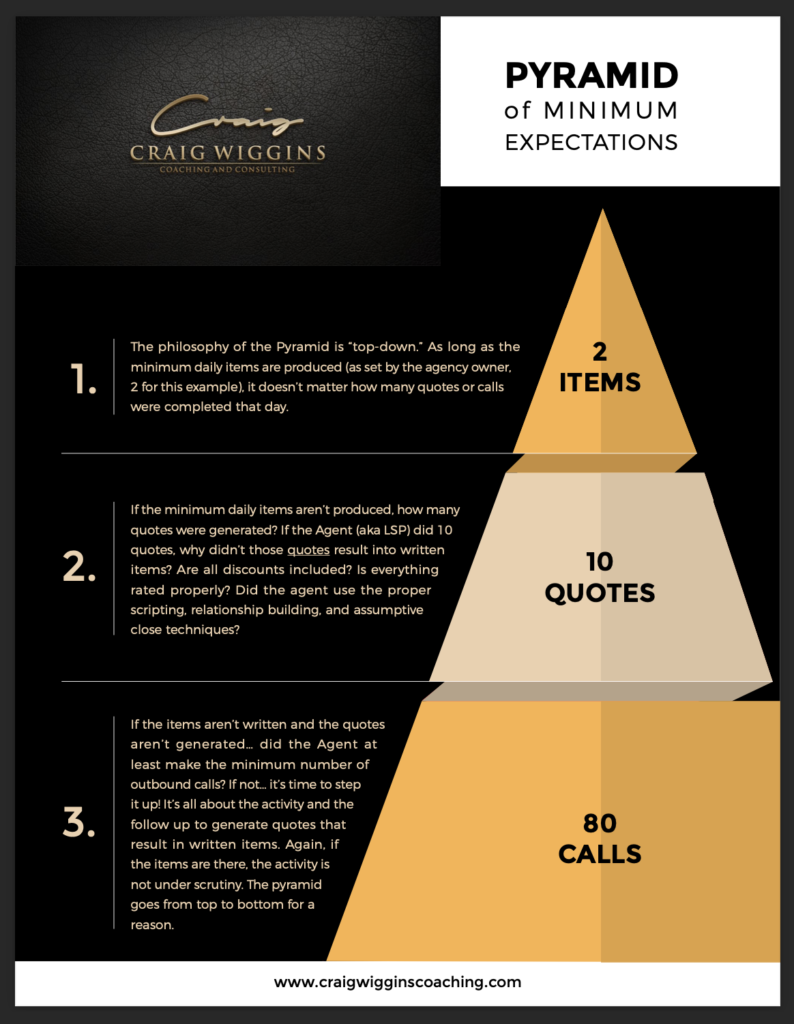

Step 4: Breaking accountability down to daily metrics is the key to success.

- Once you’ve gathered all of the above critical financial information, you need to take their average premium and comp plan to create their “financial goal number.”

- Take this “financial goal number” and break it down by daily premium.

- Then determine the number of daily quotes needed to write that much premium.

- Followed by the number of calls needed each day to generate that many quotes.

- Then, most importantly, hold them accountable to that plan – their plan.

Review and download our handy “Pyramid of Minimum Expectations” guide that helps further illustrates this step and set minimum daily expectations.

Challenge yourself to have these conversations with your staff in real-time, and watch how it helps keep your agents on task. And how making it all about them turns what used to be confrontations into conversations that show that you care.

Click the image for full resolution download now –>